Budget Chaos and What It Means for Brighton & Hove Landlords

26th November 2025

Well that was interesting! Today’s Budget took an unexpected twist when the details were released in full and online by the Office for Budget Responsibility (OBR) before the Chancellor presented them in Parliament.

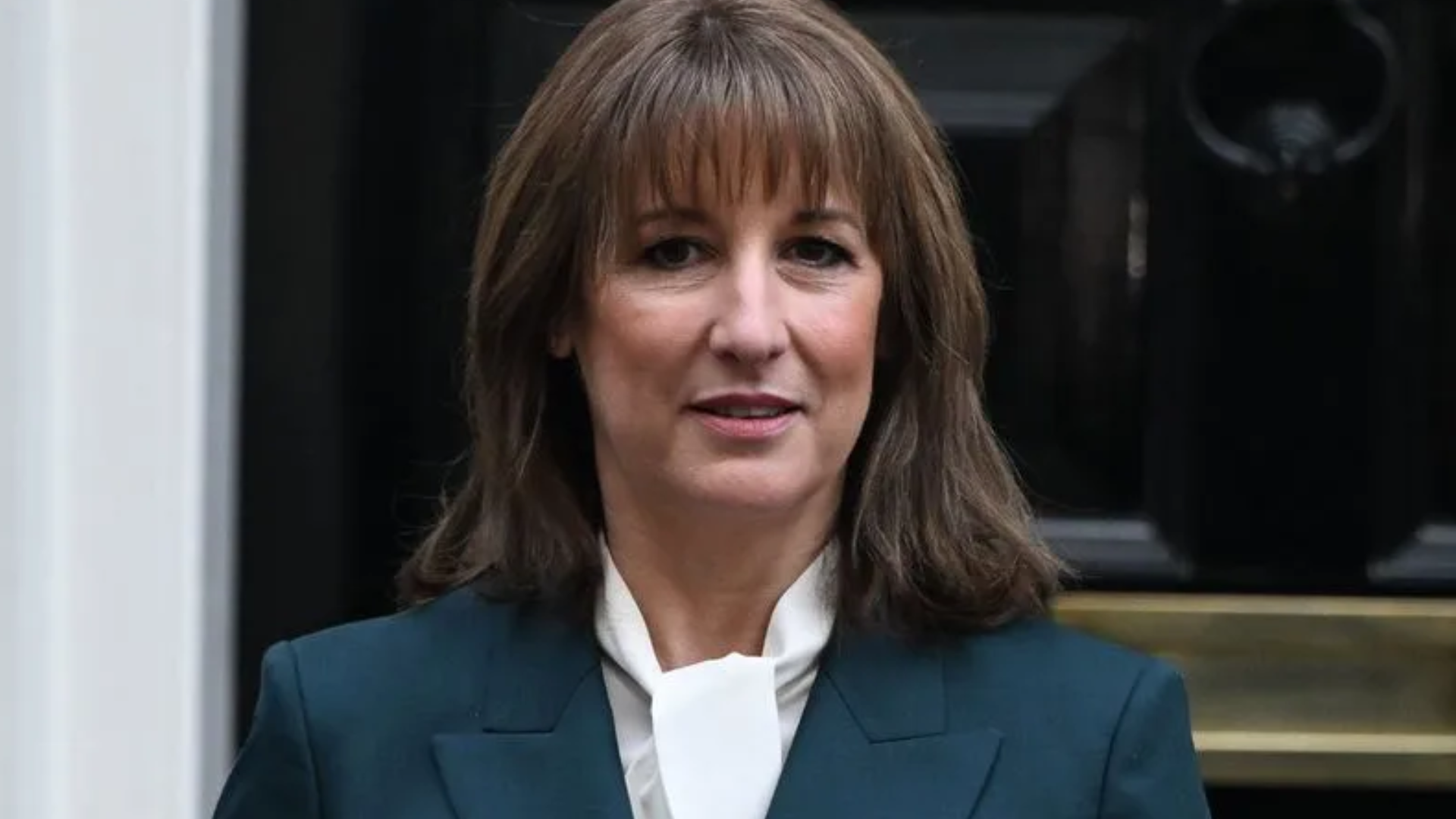

In a unique and unprecedented situation, experts were able to trawl through the paperwork and details of the new budget ahead of Rachel Reeves’ address.

While most headlines focused on political reaction, scrapping the two child benefit cap and milage tax on electric vehicles here are meaningful implications for landlords and property owners in Brighton & Hove.

Landlords’ Tax Changes Confirmed

Rachel Reeves confirmed a shift in taxation on property income.

Summary of the announced change:

-

“A landlord with an income of £25,000 will pay nearly £1,200 less tax than their tenants currently do.” Rachel Reeves, Chancellor of the Exchequer

-

There is still no National Insurance applied to property dividend income.

-

The government will:

- Increase basic and higher rate tax on property savings and dividend income by 2 percentage points

- Increase the additional rate on property savings and dividend income by 2 percentage points

What this suggests:

These measures are designed to reduce the gap between taxation on investment-based income (like rental profits) and taxation on work-based income. While this does not directly increase tax on rent, it does increase taxation on dividends/property savings, marginally tightening returns from rental investments.

Mansion tax introduced

The Mansion Tax Arrives

The leaked OBR paper confirms a “high value council tax surcharge” on properties valued over £2m, starting April 2028. Revenue from this surcharge will be collected centrally by government, not by local councils like Brighton & Hove City Council.

For Brighton & Hove, where premium coastal property values already outpace many UK regions, this may:

-

Affect the high-end Hove seafront and central Brighton Regency market.

-

Add long-term costs to buyers and owners planning to hold these homes.

Inflation and Energy: Relief for Tenants, Pressure for Landlords

The Chancellor as revealed plans to implement several measures to cut household bills, including:

- Removing the Energy Company Obligation (ECO), which will save the average household £150 on their energy bills from April 2026.

- Freezing regulated rail fares in England, saving commuters hundreds of pounds off season tickets.

- Extending the freeze on prescription fees to keep costs under £10.

- Increasing the National Living Wage and National Minimum Wage, which will see full-time workers on the National Living Wage rise by £900 a year.

- Freezing fuel duty until September 2026, with a staggered approach to reversing it.

These measures are part of the government’s broader strategy to address the cost of living crisis and provide financial relief to households.

The OBR also confirmed:

-

Household gas and electricity bills will be reduced via cuts to green levies.

-

This is likely to lower inflation, potentially reducing pressure for rent increases.

However, landlords will continue to operate in a market where:

-

Mortgage rates remain high.

-

Repairs, materials, and management costs continue to rise.

Ongoing Fairness Debate

Taxes continue to lean on the average working household. The changes on property are subtle yet politically strategic: shifting towards parity without provoking dramatic market reaction.

Brighton & Hove landlords should expect further reform. The narrative around “closing the gap between tax on assets and work” signals ongoing change throughout this parliament.

We will continue monitoring legislation affecting:

-

Rental profits

-

Capital Gains Tax

-

Mortgage interest relief

-

The Renters Reform Act implementation locally

Sign up to our newsletter to stay up to date with market insights and legislation changes

The Tenant Shortlist: A New Lettings Trend Landlords Should Know

18th February 2026

For years, rental success was often measured by one simple metric. How many enquiries did a property receive. The more…

Five Quick Fixes to Keep Rental Properties Mould Free in Wet Weather

18th February 2026

You have probably seen the news that it has rained somewhere in the UK every day so far this year….

From Party Pads to Pinterest Kitchens: What Student Tenant Behaviours Have Shifted

18th February 2026

Forget Beer Fridges. Today’s Tenants Want Kitchen Islands. The rental market has not just shifted in price and regulation. Tenant…