Budget Summary at a Glance

26th November 2025

A chaotic start with early publication from the OBR, but here’s what actually matters from today’s fiscal plan:

Budget Summary

• £26 billion in additional taxes announced for this parliament

• Taxes on dividends, property income and savings income will rise by two percentage points across basic, higher and additional rates

• New high value council tax surcharge for homes worth more than £2 million from April 2028 with revenues going to central government

• Income tax thresholds and National Insurance thresholds will be frozen for several more years pushing more people into higher tax brackets

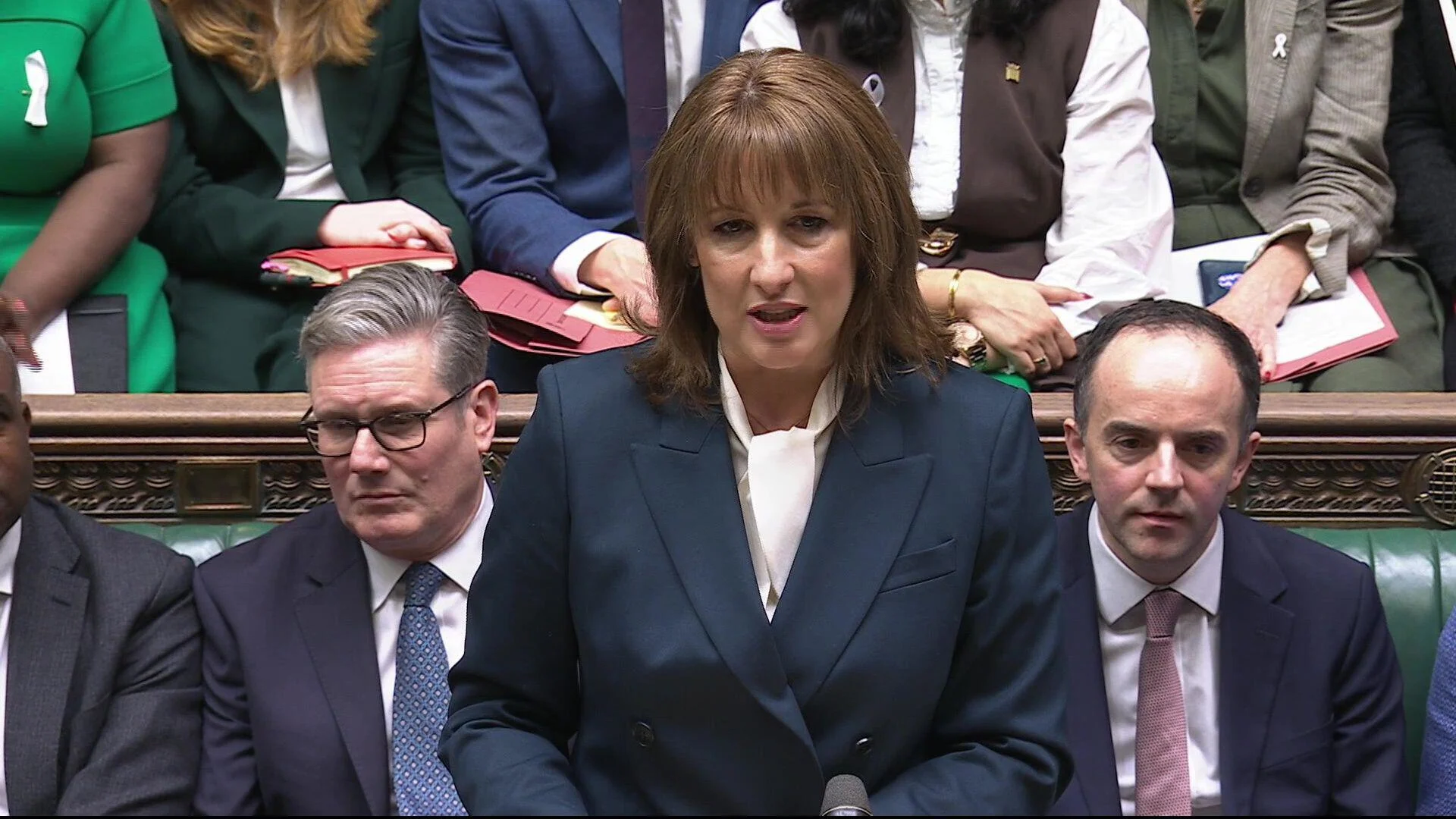

• OBR mistakenly published the Budget before the Chancellor delivered it in Parliament allowing experts to examine proposals early

• Household gas and electricity bills expected to fall due to cuts in green levies

• Electric vehicles to move to a mileage based charging system from 2028

• Pension allowances via salary sacrifice above £2,000 a year will be subject to National Insurance from 2029

• Capital gains tax breaks for Employee Ownership Trusts and other reliefs to be tightened

• Gambling and certain savings products to face higher taxation

• Financial market reaction initially positive with a short rise in the value of the pound

Overall

The Budget leans heavily on raising revenue through taxes on assets, property and investment income while freezing thresholds that draw more people into higher income taxation. The government is seeking to narrow the gap between taxes on work and taxes on wealth, signalling further reforms ahead.

The Tenant Shortlist: A New Lettings Trend Landlords Should Know

18th February 2026

For years, rental success was often measured by one simple metric. How many enquiries did a property receive. The more…

Five Quick Fixes to Keep Rental Properties Mould Free in Wet Weather

18th February 2026

You have probably seen the news that it has rained somewhere in the UK every day so far this year….

From Party Pads to Pinterest Kitchens: What Student Tenant Behaviours Have Shifted

18th February 2026

Forget Beer Fridges. Today’s Tenants Want Kitchen Islands. The rental market has not just shifted in price and regulation. Tenant…