Stamp Duty Land Tax decrease

8th November 2019

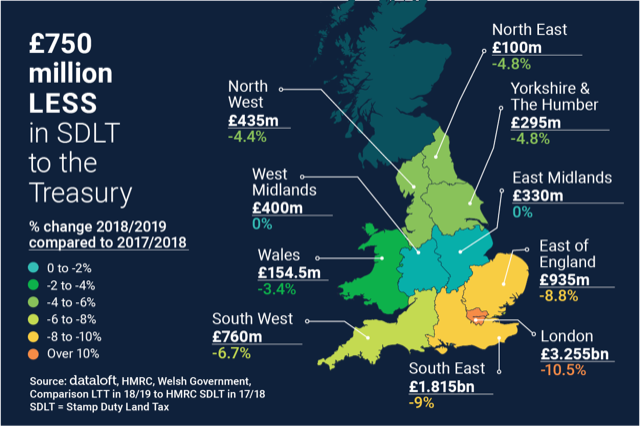

At £8.32 billion, Treasury coffers netted £750 million less in residential SDLT (Stamp Duty Land Tax) receipts across England in the financial year to the end of April, compared to 2017/18. This is despite just 16,000 fewer transactions taking place.

All regions witnessed a fall in receipts except for the East and West Midlands. The London market accounts for over half the fall, with receipts down by more than 10% over the year, the equivalent to £380 million.

45% of SDLT income in England and 38% of LTT income across Wales, is attributable to properties that were subject to the Higher Rate of Additional Dwellings tax, the 3% element accounting for a fifth of total receipts collected.

Across England close to 214,000 first-time buyers benefited from Stamp Duty Relief, a loss to the Treasury of over half a billion.

The Tenant Shortlist: A New Lettings Trend Landlords Should Know

18th February 2026

For years, rental success was often measured by one simple metric. How many enquiries did a property receive. The more…

Five Quick Fixes to Keep Rental Properties Mould Free in Wet Weather

18th February 2026

You have probably seen the news that it has rained somewhere in the UK every day so far this year….

From Party Pads to Pinterest Kitchens: What Student Tenant Behaviours Have Shifted

18th February 2026

Forget Beer Fridges. Today’s Tenants Want Kitchen Islands. The rental market has not just shifted in price and regulation. Tenant…