Stamp Duty Land Tax decrease

8th November 2019

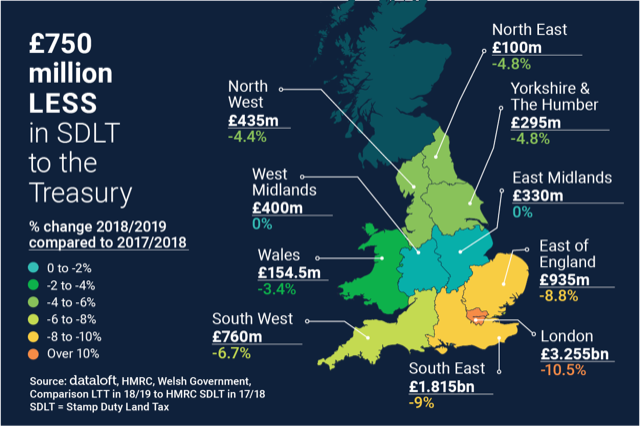

At £8.32 billion, Treasury coffers netted £750 million less in residential SDLT (Stamp Duty Land Tax) receipts across England in the financial year to the end of April, compared to 2017/18. This is despite just 16,000 fewer transactions taking place.

All regions witnessed a fall in receipts except for the East and West Midlands. The London market accounts for over half the fall, with receipts down by more than 10% over the year, the equivalent to £380 million.

45% of SDLT income in England and 38% of LTT income across Wales, is attributable to properties that were subject to the Higher Rate of Additional Dwellings tax, the 3% element accounting for a fifth of total receipts collected.

Across England close to 214,000 first-time buyers benefited from Stamp Duty Relief, a loss to the Treasury of over half a billion.

Who, How and Why of HMO Investors

12th July 2024

Around half of HMO (house in multiple occupation) landlords surveyed said that they use their property or portfolio as their…

Understanding the Labour Party’s Plans for the Rental Market

12th July 2024

With the Labour Party’s recent take over, we look back at their manifesto to identify the significant changes that are…

Explore Non-Traditional Deposit Options, Company Guarantors & Bills Packages: A Win-Win for Landlords and Tenants

12th July 2024

As the rental market evolves, there has been a notable 25%+ increase in demand for alternative deposit solutions, according to…