Interest rate expectations

7th October 2022

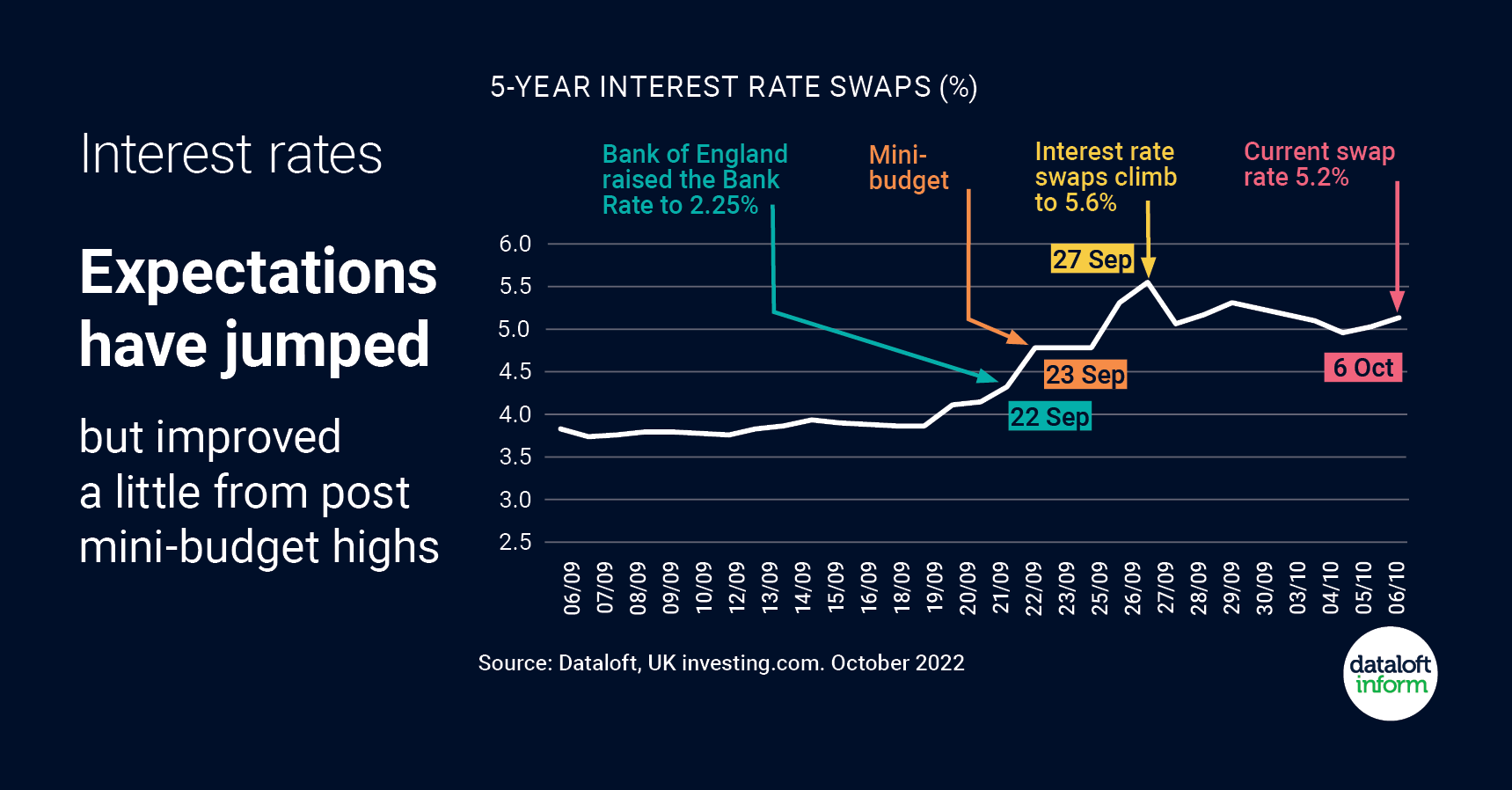

As widely reported, the Chancellor’s mini-budget spooked markets and resulted in the value of the pound sliding and interest rate expectations jumping up.

Swap rates are often used as an early warning of where mortgage interest rates are heading. Immediately after the mini-budget, 5-year swap rates climbed to a high of 5.6% but have since improved a little to 5.2%.

The next few weeks leading up to the Bank of England’s next meeting and the Chancellor’s budget are likely to be volatile for interest rate expectations.

Interest rates are definitely rising but with current volatility the extent they will need to rise is still unclear.

Source: Dataloft, UK investing.com

How and where to watched the real Heated Rivalry this Winter Olympics

9th February 2026

Obsessed with Heated Rivalry? Same. If you want to watch the show play out in real life minus the drama,…

Single this Valentine’s? Go Out Out.

2nd February 2026

Valentine’s can feel like a lot… overpriced dinners, awkward date pressure, and endless couples content all over your feed. But…

Hardship Funds and Hot Water Bottles: Ways You Didn’t Know You Could Save (or Make) Money This January

5th January 2026

January Blues and Making Your Money Stretch January can be a difficult month for students. After the cost of Christmas,…