Market outlook

9th October 2023

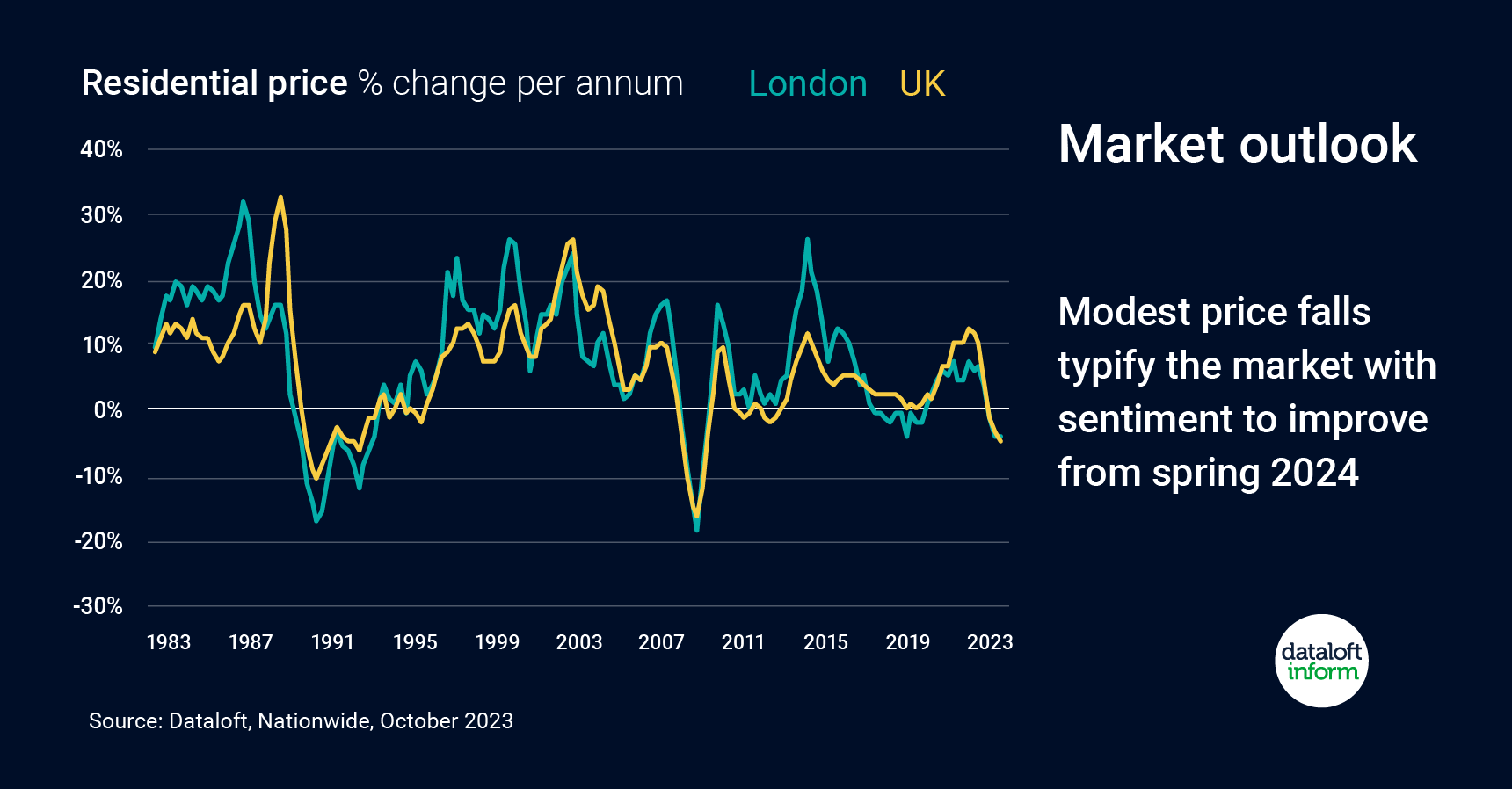

Interest rates are deemed to be at, or close to their peak so any improvement should start to lift sentiment. For the rest of 2023, expect continued low sale volumes and some price volatility but spring 2024 could mark an upturn.

Whilst one more 25bp rise in the Bank Rate is expected however, anything beyond that would be a risk to the fragile shoots of improved sentiment. So too any reversal in the downward trend in inflation.

The shock of rapid changes to interest rates in Q3 2022 triggered sharp quarterly price falls over the winter, in Q4 2022 and Q1 2023 but since then the market has stabilised and prices are actually higher today than they were at end Q1 2023.

Source: #Dataloft, Nationwide

Hardship Funds and Hot Water Bottles: Ways You Didn’t Know You Could Save (or Make) Money This January

5th January 2026

January Blues and Making Your Money Stretch January can be a difficult month for students. After the cost of Christmas,…

End of year roundup

19th December 2025

As we reach the end of the year it feels like the perfect moment for the obligatory ‘look back on…

How landlords can prepare for 2026

19th December 2025

As we move into 2026, a number of important legal, regulatory and tax changes are set to reshape the private…