Interest rate expectations

7th October 2022

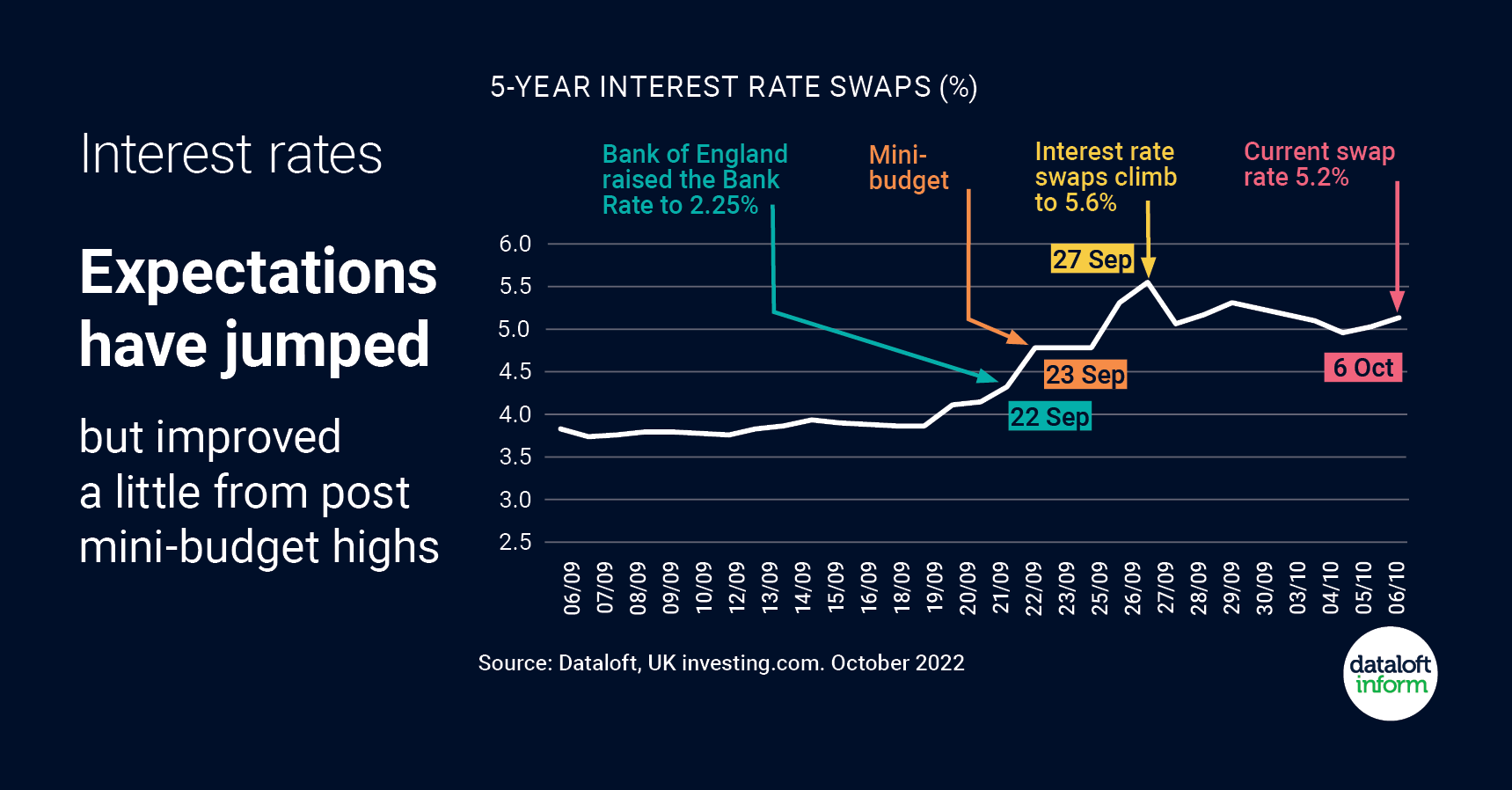

As widely reported, the Chancellor’s mini-budget spooked markets and resulted in the value of the pound sliding and interest rate expectations jumping up.

Swap rates are often used as an early warning of where mortgage interest rates are heading. Immediately after the mini-budget, 5-year swap rates climbed to a high of 5.6% but have since improved a little to 5.2%.

The next few weeks leading up to the Bank of England’s next meeting and the Chancellor’s budget are likely to be volatile for interest rate expectations.

Interest rates are definitely rising but with current volatility the extent they will need to rise is still unclear.

Source: Dataloft, UK investing.com

Who, How and Why of HMO Investors

12th July 2024

Around half of HMO (house in multiple occupation) landlords surveyed said that they use their property or portfolio as their…

Understanding the Labour Party’s Plans for the Rental Market

12th July 2024

With the Labour Party’s recent take over, we look back at their manifesto to identify the significant changes that are…

Explore Non-Traditional Deposit Options, Company Guarantors & Bills Packages: A Win-Win for Landlords and Tenants

12th July 2024

As the rental market evolves, there has been a notable 25%+ increase in demand for alternative deposit solutions, according to…