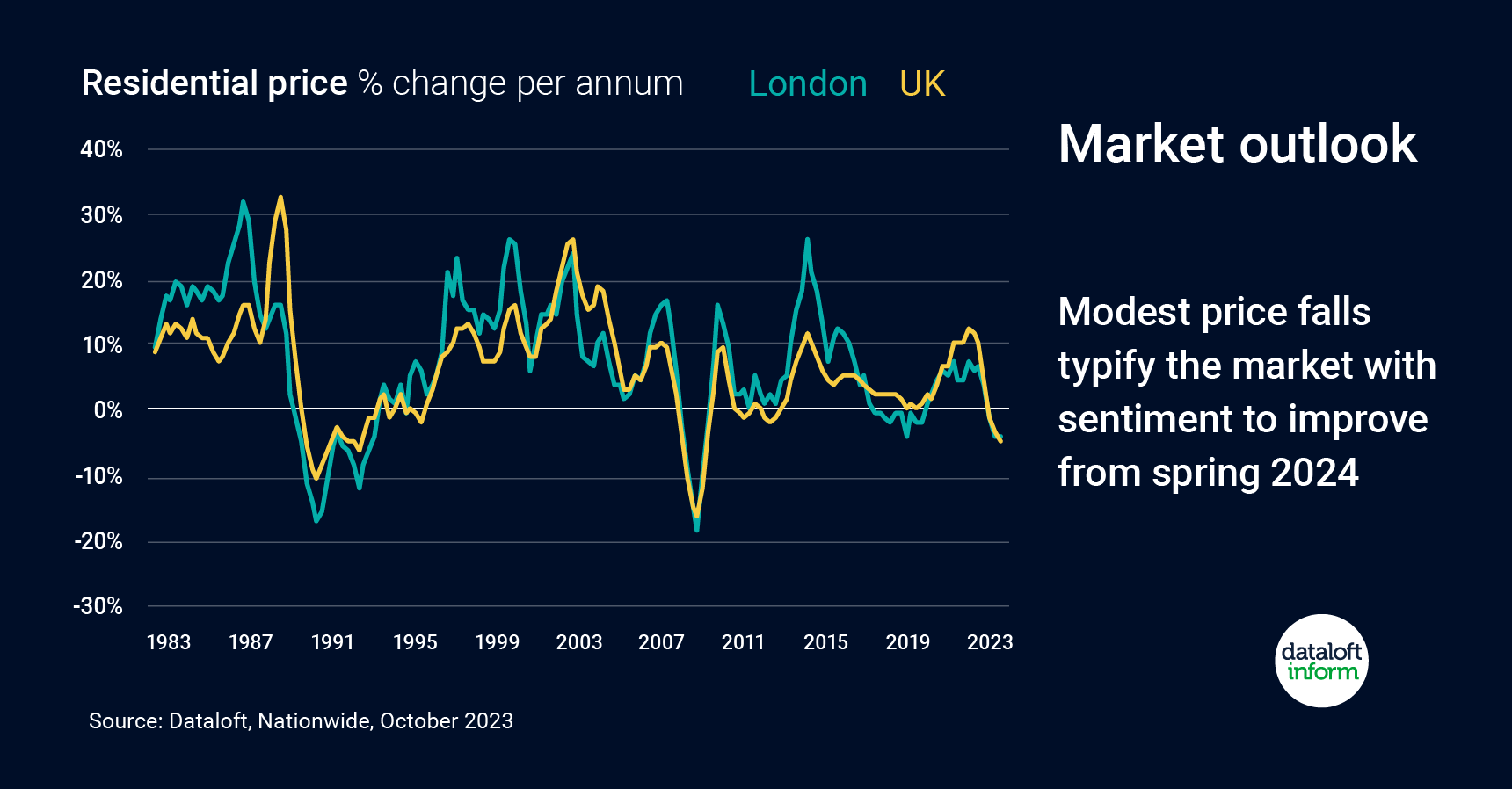

Market outlook

9th October 2023

Interest rates are deemed to be at, or close to their peak so any improvement should start to lift sentiment. For the rest of 2023, expect continued low sale volumes and some price volatility but spring 2024 could mark an upturn.

Whilst one more 25bp rise in the Bank Rate is expected however, anything beyond that would be a risk to the fragile shoots of improved sentiment. So too any reversal in the downward trend in inflation.

The shock of rapid changes to interest rates in Q3 2022 triggered sharp quarterly price falls over the winter, in Q4 2022 and Q1 2023 but since then the market has stabilised and prices are actually higher today than they were at end Q1 2023.

Source: #Dataloft, Nationwide

The Tenant Shortlist: A New Lettings Trend Landlords Should Know

18th February 2026

For years, rental success was often measured by one simple metric. How many enquiries did a property receive. The more…

Five Quick Fixes to Keep Rental Properties Mould Free in Wet Weather

18th February 2026

You have probably seen the news that it has rained somewhere in the UK every day so far this year….

From Party Pads to Pinterest Kitchens: What Student Tenant Behaviours Have Shifted

18th February 2026

Forget Beer Fridges. Today’s Tenants Want Kitchen Islands. The rental market has not just shifted in price and regulation. Tenant…