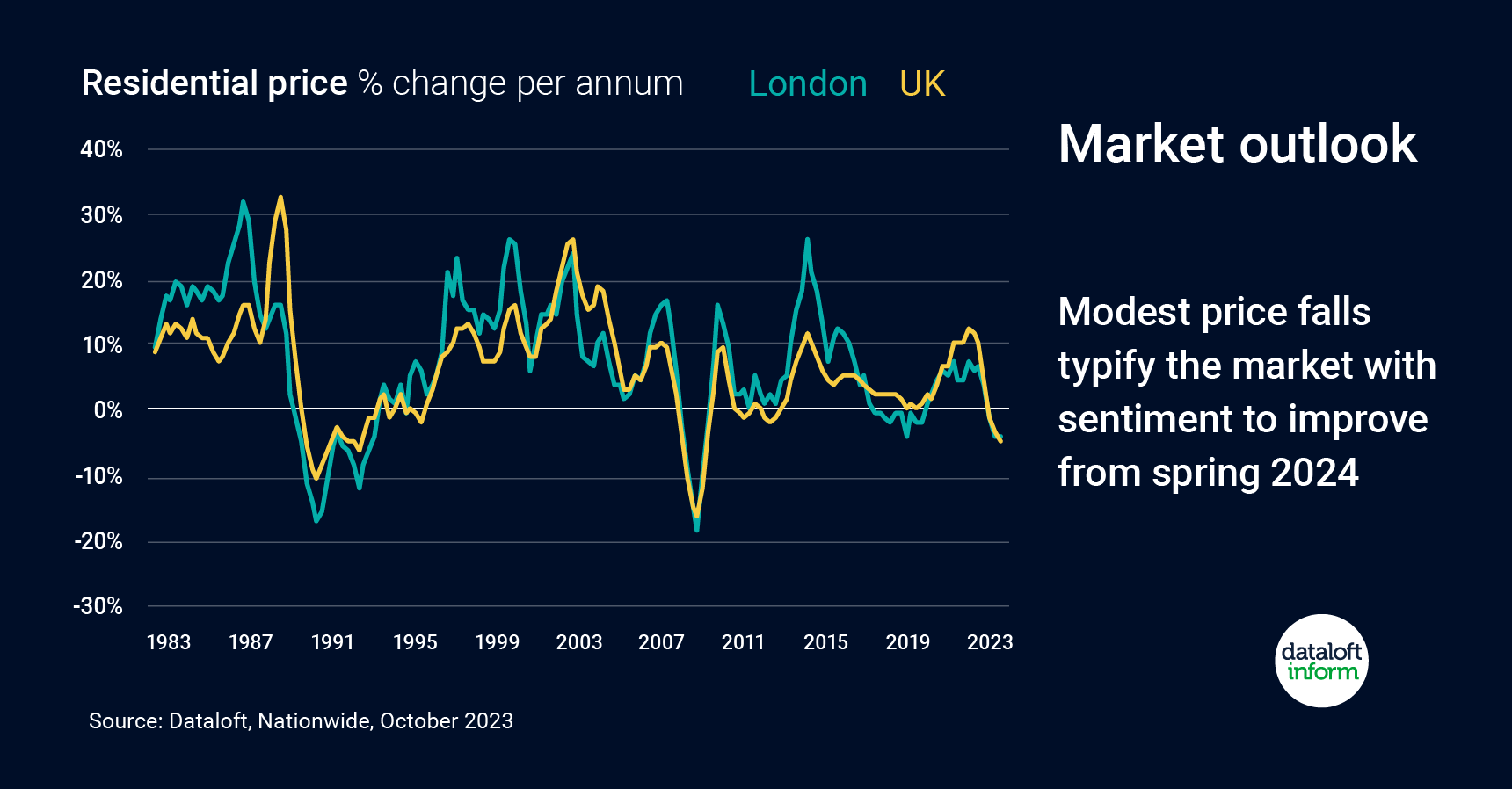

Market outlook

9th October 2023

Interest rates are deemed to be at, or close to their peak so any improvement should start to lift sentiment. For the rest of 2023, expect continued low sale volumes and some price volatility but spring 2024 could mark an upturn.

Whilst one more 25bp rise in the Bank Rate is expected however, anything beyond that would be a risk to the fragile shoots of improved sentiment. So too any reversal in the downward trend in inflation.

The shock of rapid changes to interest rates in Q3 2022 triggered sharp quarterly price falls over the winter, in Q4 2022 and Q1 2023 but since then the market has stabilised and prices are actually higher today than they were at end Q1 2023.

Source: #Dataloft, Nationwide

Who, How and Why of HMO Investors

12th July 2024

Around half of HMO (house in multiple occupation) landlords surveyed said that they use their property or portfolio as their…

Understanding the Labour Party’s Plans for the Rental Market

12th July 2024

With the Labour Party’s recent take over, we look back at their manifesto to identify the significant changes that are…

Explore Non-Traditional Deposit Options, Company Guarantors & Bills Packages: A Win-Win for Landlords and Tenants

12th July 2024

As the rental market evolves, there has been a notable 25%+ increase in demand for alternative deposit solutions, according to…