Unlocking home ownership

21st August 2023

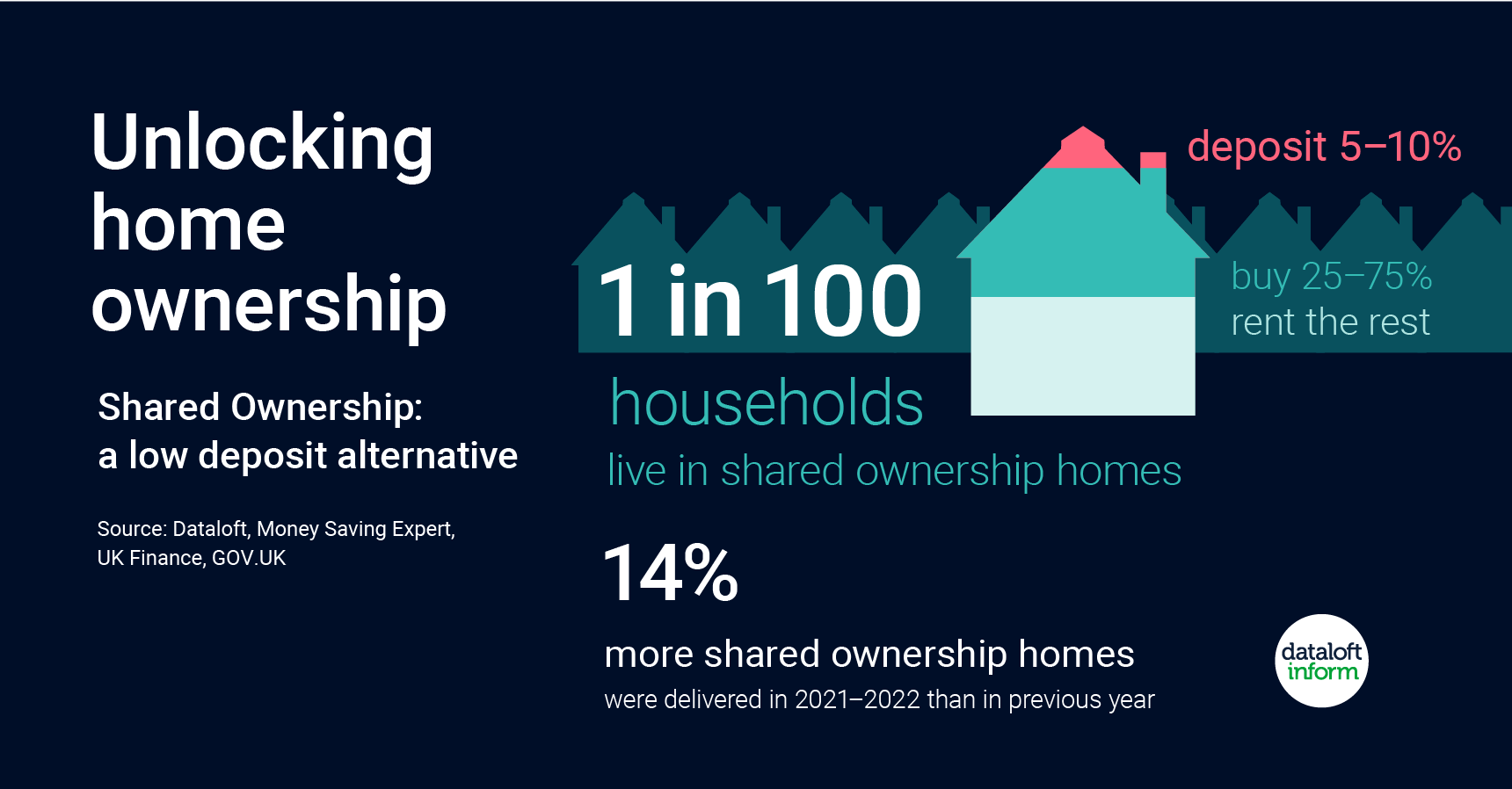

With the close of the Help to Buy scheme, there is a clear gap for those looking for a low deposit solution to buying a home. Around 1 in every 100 households in the country live in shared ownership homes.

Shared ownership gives buyers the option to buy a share (between 25% and 75%) of their home, and pay rent on the remaining share. Over time more shares can be bought and the home can eventually be owned outright.

The required deposit (usually between 5% and 10% of the share bought) is significantly less than the average deposit of 24% paid by UK first-time buyers, making it an affordable option for home ownership.

Not exclusive to first-time buyers, those with a household income of £80,000 a year or less (£90,000 or less in London) and that cannot afford a home that meets their needs can qualify. Source: #Dataloft, Money Saving Expert, UK Finance, GOV.UK

The Tenant Shortlist: A New Lettings Trend Landlords Should Know

18th February 2026

For years, rental success was often measured by one simple metric. How many enquiries did a property receive. The more…

Five Quick Fixes to Keep Rental Properties Mould Free in Wet Weather

18th February 2026

You have probably seen the news that it has rained somewhere in the UK every day so far this year….

From Party Pads to Pinterest Kitchens: What Student Tenant Behaviours Have Shifted

18th February 2026

Forget Beer Fridges. Today’s Tenants Want Kitchen Islands. The rental market has not just shifted in price and regulation. Tenant…