Unlocking home ownership

21st August 2023

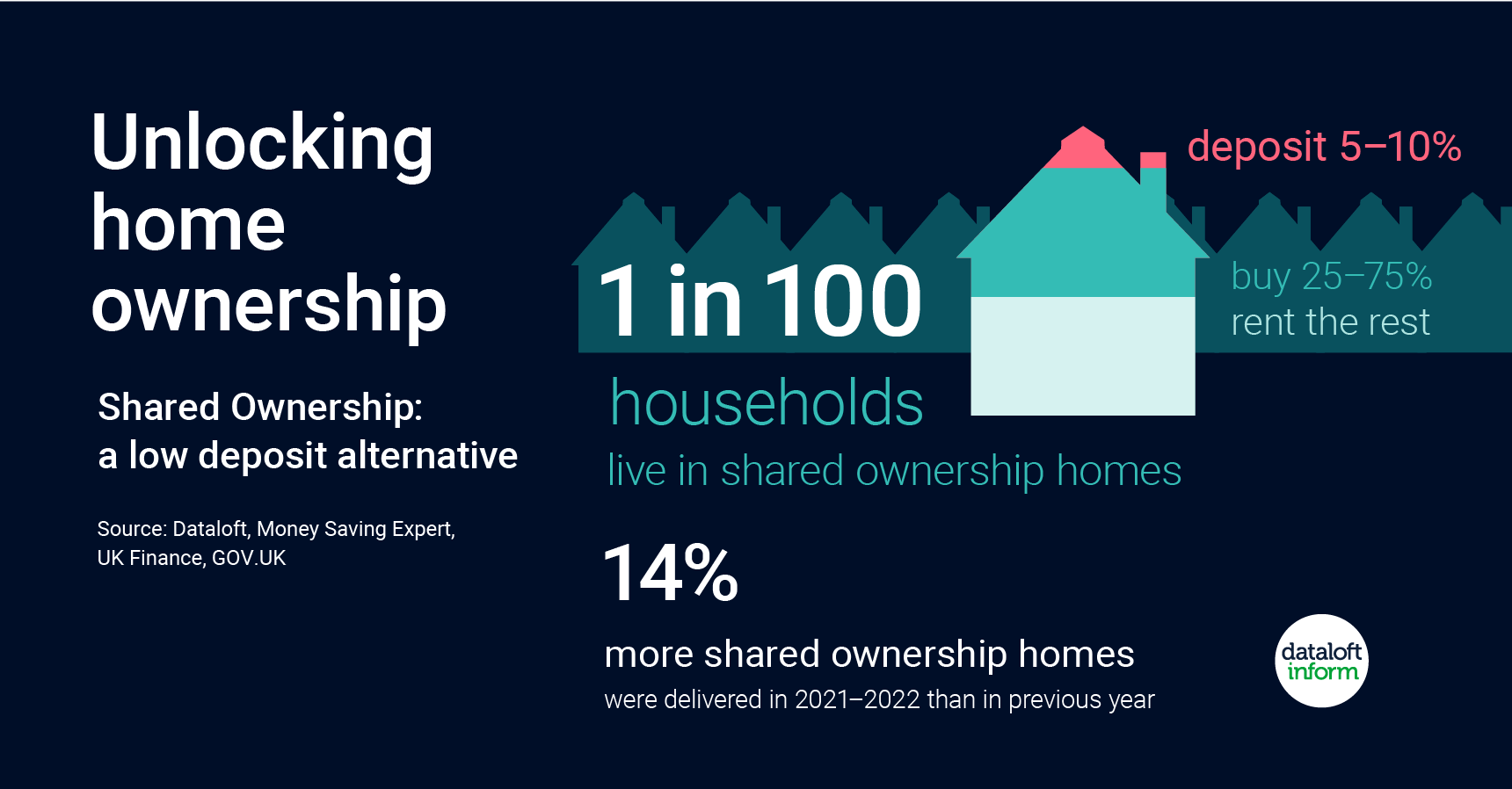

With the close of the Help to Buy scheme, there is a clear gap for those looking for a low deposit solution to buying a home. Around 1 in every 100 households in the country live in shared ownership homes.

Shared ownership gives buyers the option to buy a share (between 25% and 75%) of their home, and pay rent on the remaining share. Over time more shares can be bought and the home can eventually be owned outright.

The required deposit (usually between 5% and 10% of the share bought) is significantly less than the average deposit of 24% paid by UK first-time buyers, making it an affordable option for home ownership.

Not exclusive to first-time buyers, those with a household income of £80,000 a year or less (£90,000 or less in London) and that cannot afford a home that meets their needs can qualify. Source: #Dataloft, Money Saving Expert, UK Finance, GOV.UK

I didn’t get a place in halls of residence – now what?!

28th August 2024

So, you’ve just found out you didn’t get a place in halls of residence, firstly, don’t panic! Your exciting move…

Selective Licensing – Discussion with the council

19th August 2024

When Will It Come into Place? Applications open on Monday 2nd September; penalties will incur if applications are sent after…

Employee of the Month – August

19th August 2024

Our employee of the Month for August is one of the faces of front-desk! One of our office administrators, Harriet…