What is happening to property prices?

2nd May 2023

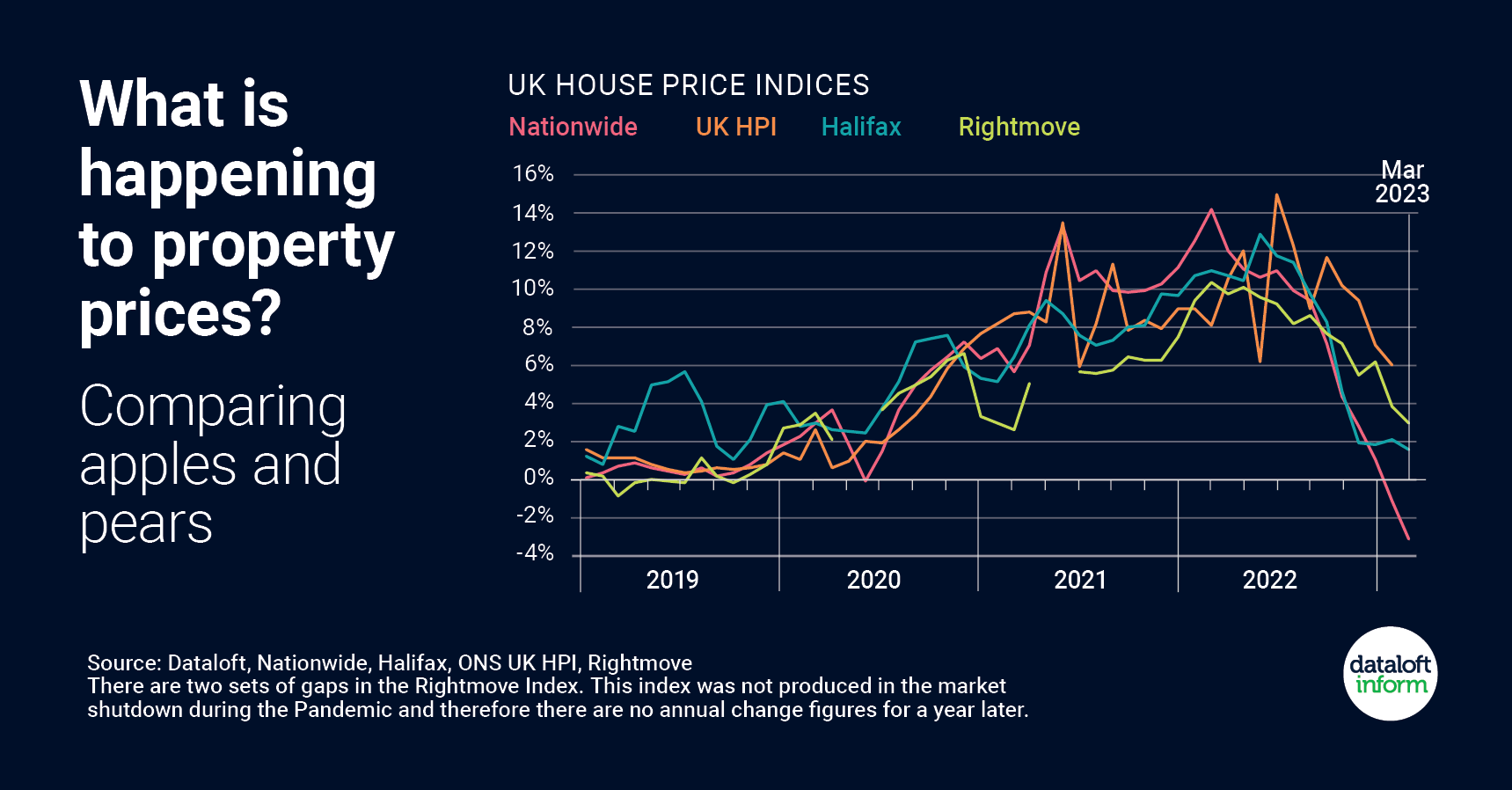

Average UK property prices and annual price growth are published by various organisations. However, the figures are different for each and can cause confusion. This is because the data is calculated in slightly different ways.

Rightmove average prices are the highest, but their index is based on the asking prices of newly listed properties (around 100,000 each month), not on sales prices. In comparison, the ONS UK HPI index uses final sales prices, including for cash and mortgage sales, recorded by the Land Registry. It includes around 80,000-100,000 sales per month.

Halifax and Nationwide use their own mortgage applications at approval stage (around 12,000-15,000 per month). The average price quoted by Nationwide is usually the lowest. The differences in the source of the data, as well as the statistical calculations that make up each index, explains their variations.

Comparing the indexes against each other is like comparing apples with pears. However, despite the variation in methodologies, the overall trend direction noted by each organisation is similar. It is this overall trend which is important when considering what is happening in the current market. Source: Dataloft, Nationwide, Halifax, ONS UK HPI, Rightmove

Who, How and Why of HMO Investors

12th July 2024

Around half of HMO (house in multiple occupation) landlords surveyed said that they use their property or portfolio as their…

Understanding the Labour Party’s Plans for the Rental Market

12th July 2024

With the Labour Party’s recent take over, we look back at their manifesto to identify the significant changes that are…

Explore Non-Traditional Deposit Options, Company Guarantors & Bills Packages: A Win-Win for Landlords and Tenants

12th July 2024

As the rental market evolves, there has been a notable 25%+ increase in demand for alternative deposit solutions, according to…