Clear relationship between mortgage approvals and sales volumes

3rd April 2023

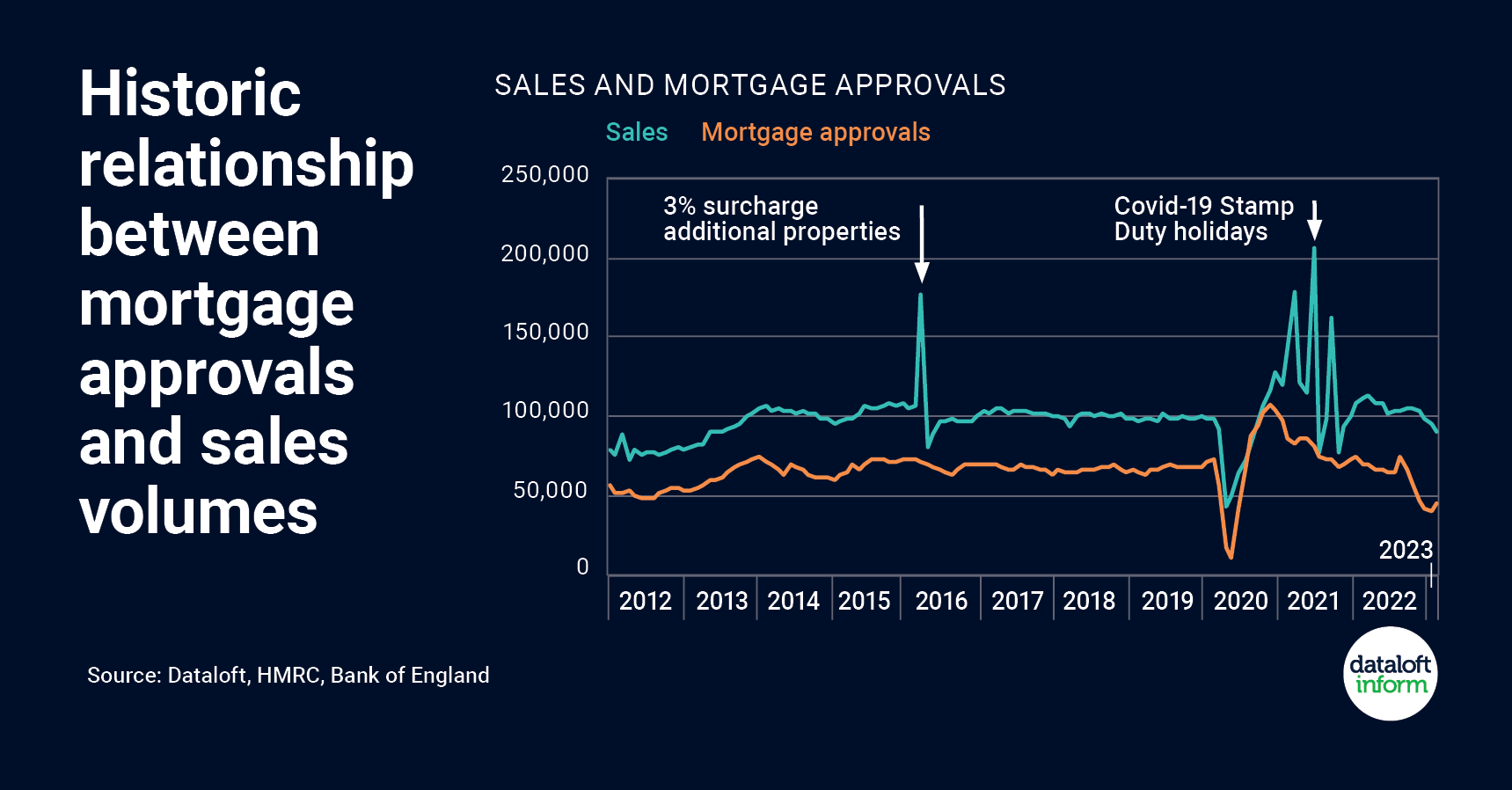

Official data indicates sales volumes in February were 4% lower than January, while mortgage approvals for the month were 10% higher, the most significant uptick at this time of year since 2011.

In the 5 years prior to the pandemic, mortgage approvals in February were on average 1.2% lower than in January. With mortgage approvals considered a forerunner of housing market activity, demand in the sales market is likely to rise over the spring.

The mortgage market is stablising. The decision by the Bank of England to raise the base rate of interest to 4.25% was largely expected and there has been little movement in long-term swap rates since the announcement.

Spikes in sales volumes in recent times have historically been linked to government changes to property taxation. The impact of changes in 2016 and 2021 is clearly visible.

In the last decade peaks in the sales market have been associated with changes to property taxation including the 3% surcharge on additional homes in 2016 and the Stamp Duty Holiday in 2021. Source: Dataloft, HMRC, Bank of England

Hardship Funds and Hot Water Bottles: Ways You Didn’t Know You Could Save (or Make) Money This January

5th January 2026

January Blues and Making Your Money Stretch January can be a difficult month for students. After the cost of Christmas,…

End of year roundup

19th December 2025

As we reach the end of the year it feels like the perfect moment for the obligatory ‘look back on…

How landlords can prepare for 2026

19th December 2025

As we move into 2026, a number of important legal, regulatory and tax changes are set to reshape the private…