Bank rate hold benefits swap rates and mortgage rates

6th November 2023

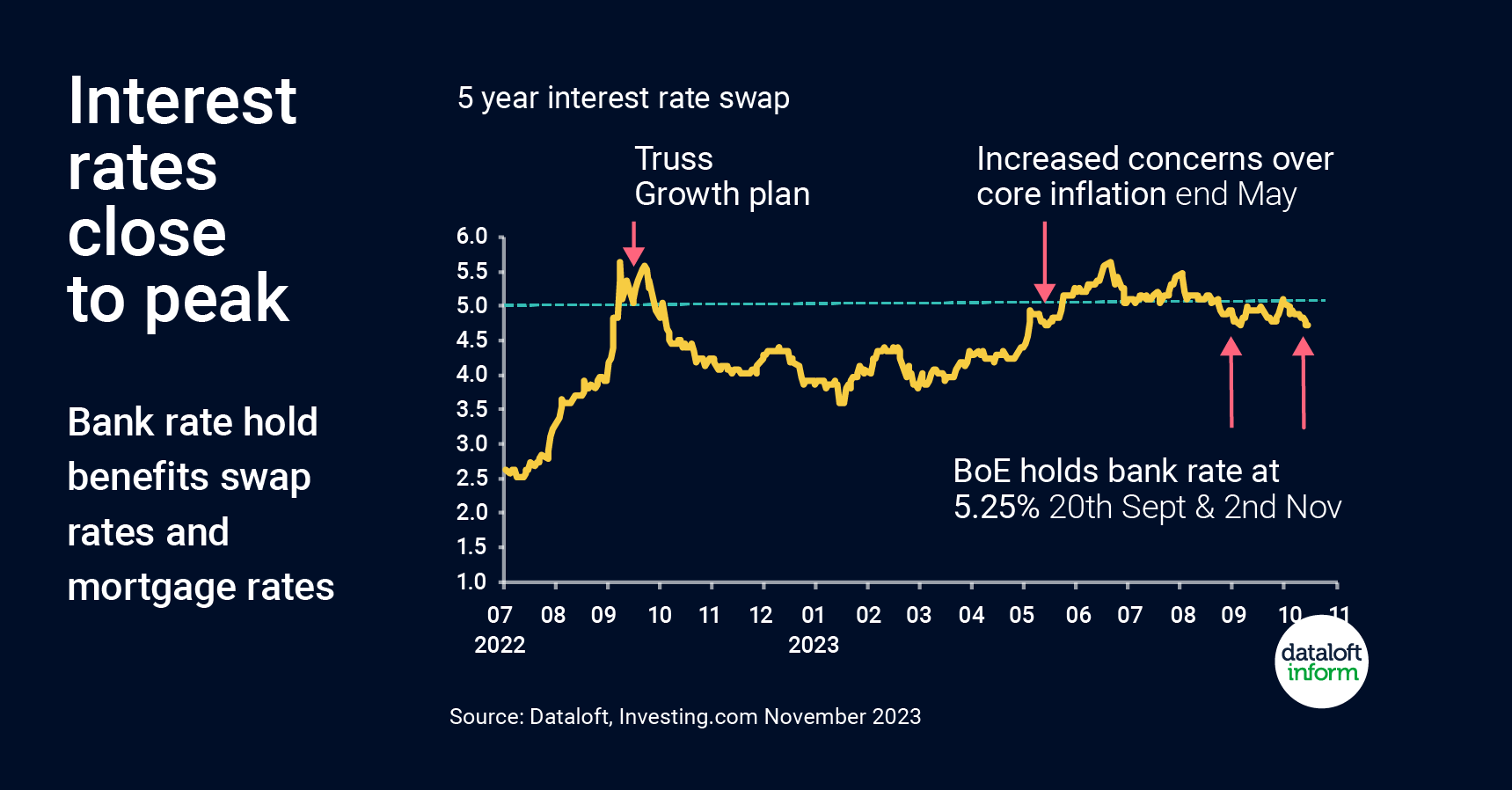

The Bank of England held the bank rate at 5.25% in their November 2023 meeting. Interest rates, through mortgage affordability, are a key determinant for the residential market outlook.

Consensus forecasts compiled by HM Treasury suggest that interest rates are at their peak. Year end forecast for the bank rate for 2023 is 5.3%, then forecast to fall to 4.7% by year end 2024.*

Swap rates give us a good indication of changes in mortgage costs – reflecting the cost of borrowing for lenders. 5 year swap rates reacted well to the Bank of England decision, now at their lowest level since May.

The market is still adjusting to higher interest rates and mortgage approvals remain low, but with interest rates at or close to their peak improvement in sentiment should be evident from Spring 2024.

Source: #Dataloft, Investing.com *HM Treasury Forecasts as at October 2023

Hardship Funds and Hot Water Bottles: Ways You Didn’t Know You Could Save (or Make) Money This January

5th January 2026

January Blues and Making Your Money Stretch January can be a difficult month for students. After the cost of Christmas,…

End of year roundup

19th December 2025

As we reach the end of the year it feels like the perfect moment for the obligatory ‘look back on…

How landlords can prepare for 2026

19th December 2025

As we move into 2026, a number of important legal, regulatory and tax changes are set to reshape the private…