Clear relationship between mortgage approvals and sales volumes

3rd April 2023

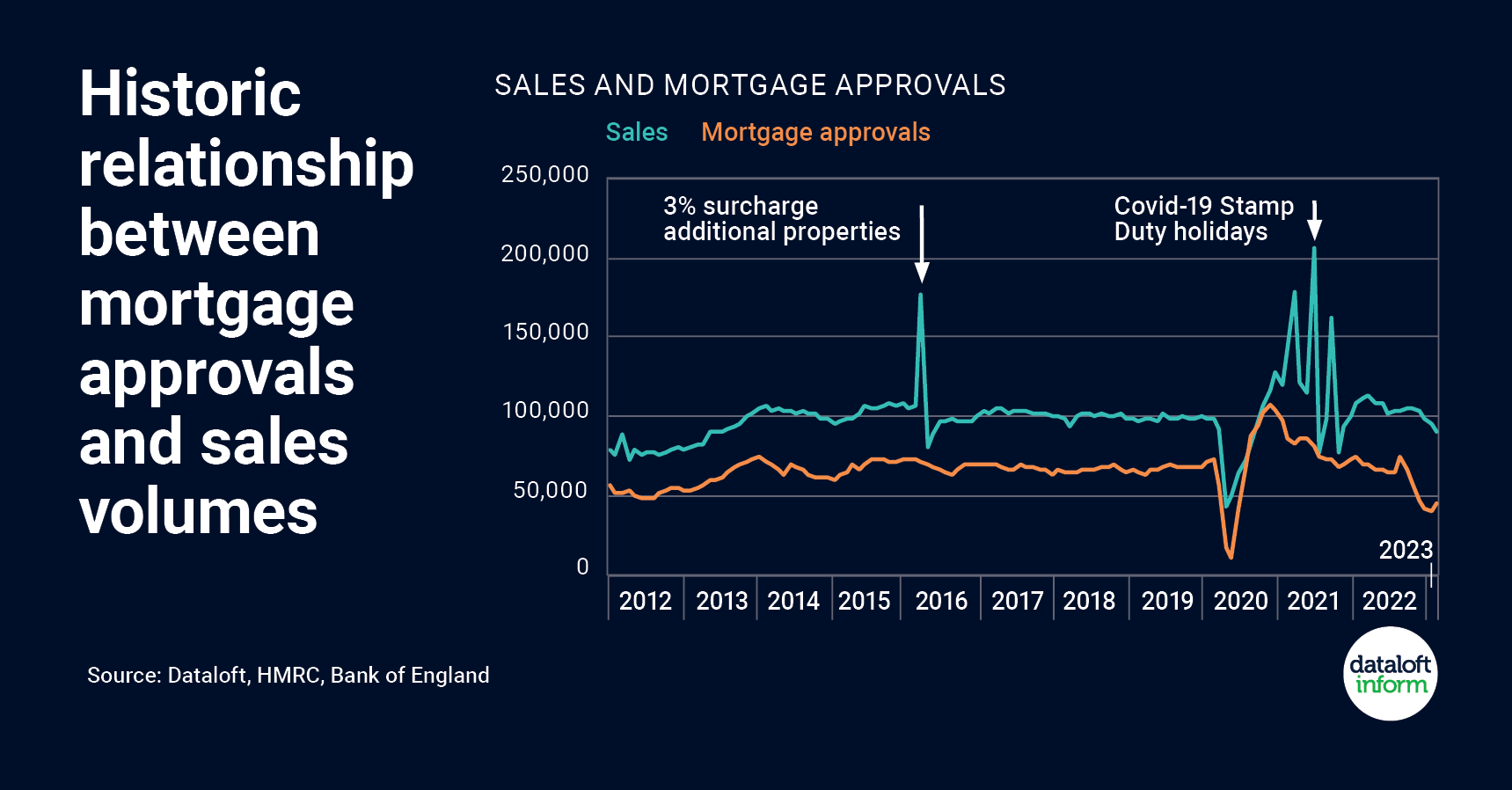

Official data indicates sales volumes in February were 4% lower than January, while mortgage approvals for the month were 10% higher, the most significant uptick at this time of year since 2011.

In the 5 years prior to the pandemic, mortgage approvals in February were on average 1.2% lower than in January. With mortgage approvals considered a forerunner of housing market activity, demand in the sales market is likely to rise over the spring.

The mortgage market is stablising. The decision by the Bank of England to raise the base rate of interest to 4.25% was largely expected and there has been little movement in long-term swap rates since the announcement.

Spikes in sales volumes in recent times have historically been linked to government changes to property taxation. The impact of changes in 2016 and 2021 is clearly visible.

In the last decade peaks in the sales market have been associated with changes to property taxation including the 3% surcharge on additional homes in 2016 and the Stamp Duty Holiday in 2021. Source: Dataloft, HMRC, Bank of England

Who, How and Why of HMO Investors

12th July 2024

Around half of HMO (house in multiple occupation) landlords surveyed said that they use their property or portfolio as their…

Understanding the Labour Party’s Plans for the Rental Market

12th July 2024

With the Labour Party’s recent take over, we look back at their manifesto to identify the significant changes that are…

Explore Non-Traditional Deposit Options, Company Guarantors & Bills Packages: A Win-Win for Landlords and Tenants

12th July 2024

As the rental market evolves, there has been a notable 25%+ increase in demand for alternative deposit solutions, according to…