Investing in HMOs

25th September 2023

Letting your property as an HMO (House in Multiple Occupancy) is a viable alternative to more traditional buy-to-let properties. Generally more profitable, HMOs provide multiple streams of income by letting out individual rooms at a higher rate than you would the entire property. This can also reduce the impact of void periods.

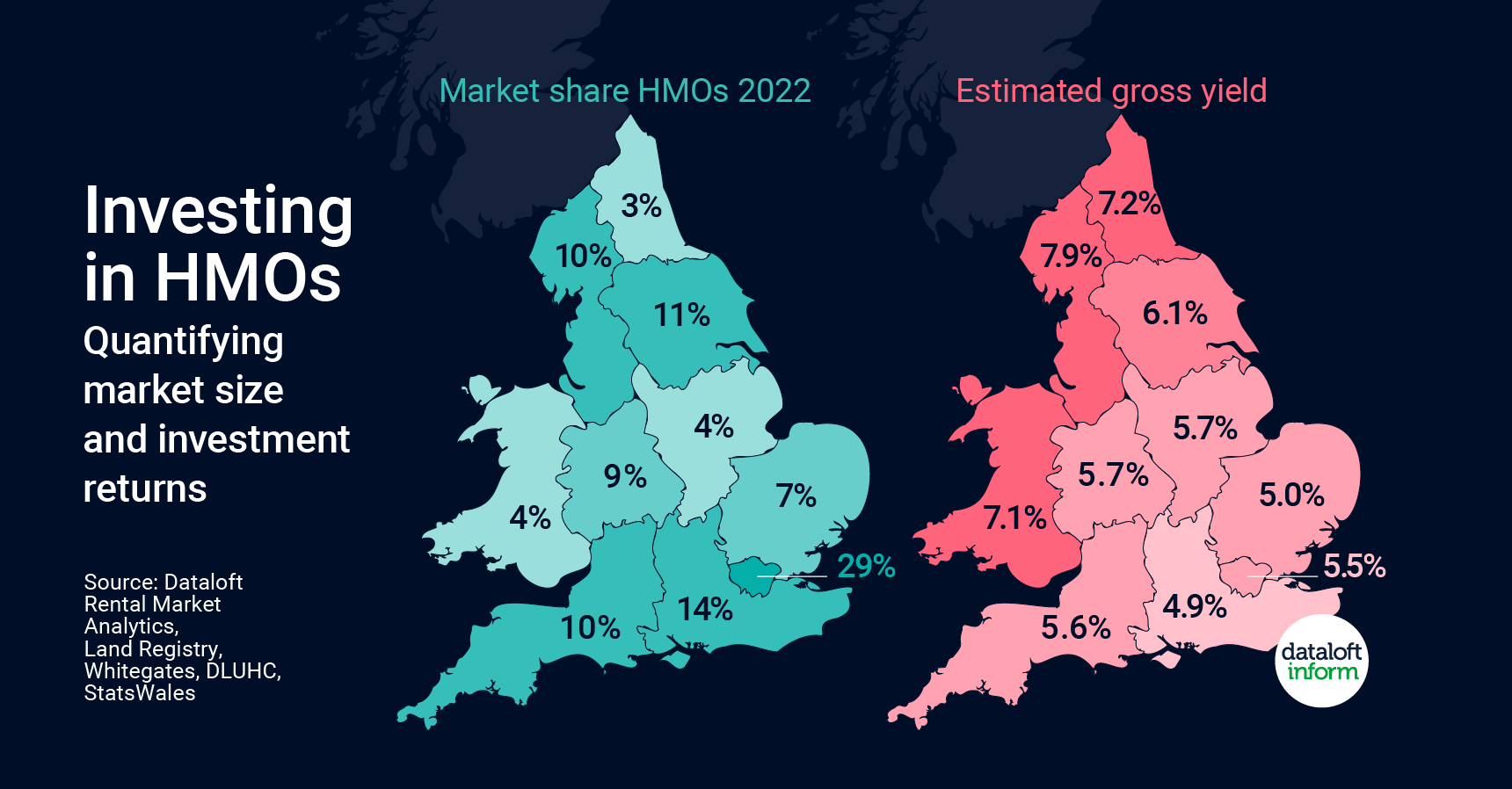

Average gross estimated yields of up to 7.9% are achievable in the North West, where student populations are high and demand for more afforable housing is strong.

Of the estimated half a million HMOs in England and Wales, by far the most (29%) are found in London. The scarcity principle applies, and places with the lowest number of HMOs such as Wales (4%) have strong average yields of 7.1%.

This clear demand for HMOs, coupled with attractive yields, provides a convincing argument for considering this method of letting.

Source: #Dataloft Rental Market Analytics, Land Registry, Whitegates, DLUHC, StatsWales

The Tenant Shortlist: A New Lettings Trend Landlords Should Know

18th February 2026

For years, rental success was often measured by one simple metric. How many enquiries did a property receive. The more…

Five Quick Fixes to Keep Rental Properties Mould Free in Wet Weather

18th February 2026

You have probably seen the news that it has rained somewhere in the UK every day so far this year….

From Party Pads to Pinterest Kitchens: What Student Tenant Behaviours Have Shifted

18th February 2026

Forget Beer Fridges. Today’s Tenants Want Kitchen Islands. The rental market has not just shifted in price and regulation. Tenant…