Investing in HMOs

25th September 2023

Letting your property as an HMO (House in Multiple Occupancy) is a viable alternative to more traditional buy-to-let properties. Generally more profitable, HMOs provide multiple streams of income by letting out individual rooms at a higher rate than you would the entire property. This can also reduce the impact of void periods.

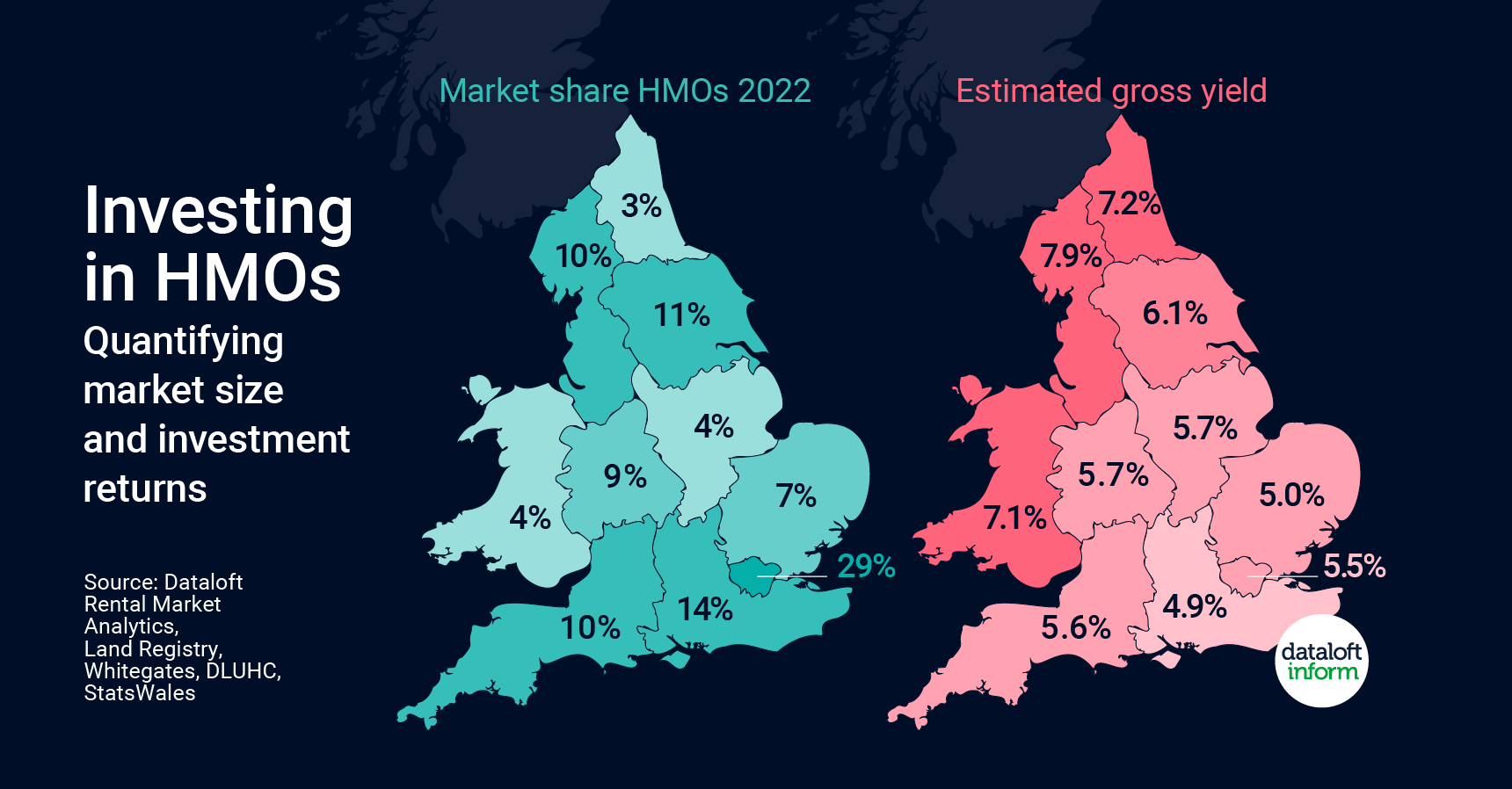

Average gross estimated yields of up to 7.9% are achievable in the North West, where student populations are high and demand for more afforable housing is strong.

Of the estimated half a million HMOs in England and Wales, by far the most (29%) are found in London. The scarcity principle applies, and places with the lowest number of HMOs such as Wales (4%) have strong average yields of 7.1%.

This clear demand for HMOs, coupled with attractive yields, provides a convincing argument for considering this method of letting.

Source: #Dataloft Rental Market Analytics, Land Registry, Whitegates, DLUHC, StatsWales

Who, How and Why of HMO Investors

12th July 2024

Around half of HMO (house in multiple occupation) landlords surveyed said that they use their property or portfolio as their…

Understanding the Labour Party’s Plans for the Rental Market

12th July 2024

With the Labour Party’s recent take over, we look back at their manifesto to identify the significant changes that are…

Explore Non-Traditional Deposit Options, Company Guarantors & Bills Packages: A Win-Win for Landlords and Tenants

12th July 2024

As the rental market evolves, there has been a notable 25%+ increase in demand for alternative deposit solutions, according to…